Affordable

Capital for All.

Automated lending and grant technology to help community lenders deploy more capital, more efficiently.

We take lending personally

Mission Driven Lenders (CDFIs, Credit Unions, Community Banks) support our communities with affordable, impact focused capital. However, community lending is often held back by outdated technology and manual processes. That's where we come in.

White

Label

Design your own custom-branded landing page and present a fresh experience for your borrowers to login and view the loan process.

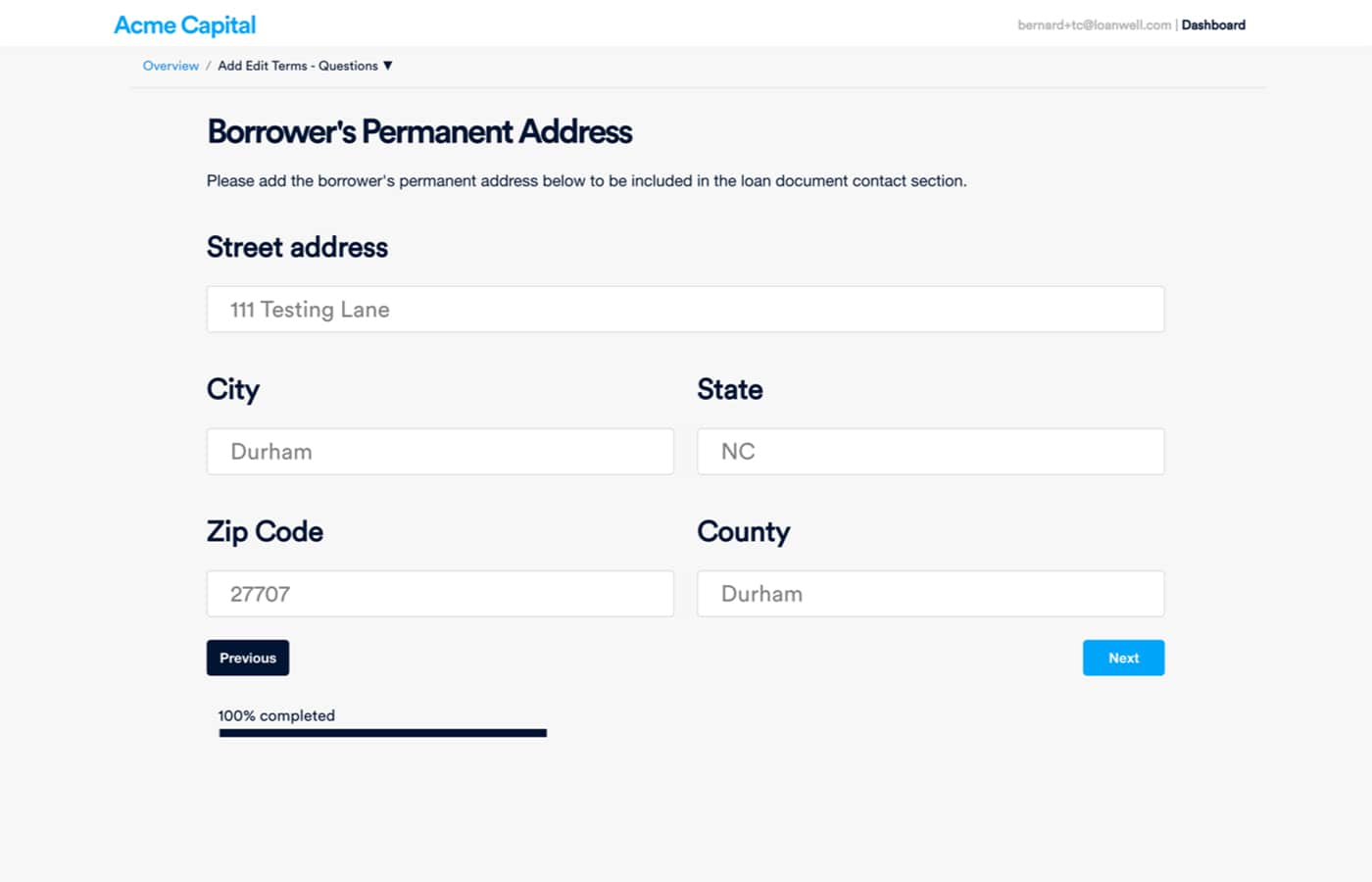

Custom Intake

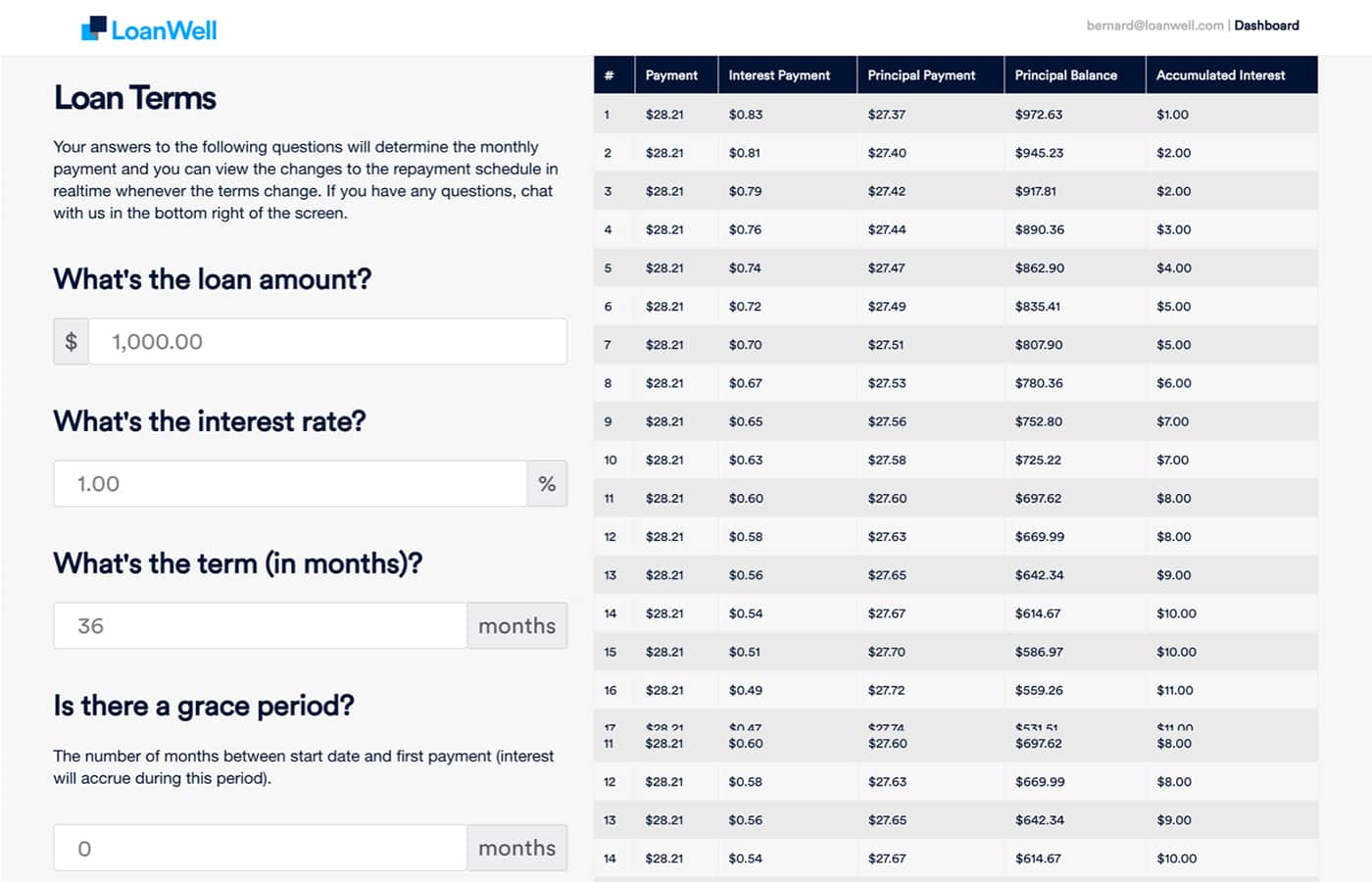

LoanWell guides the borrower during each step of the process with simple questions. We even provide tools like monthly payment calculators and savings calculator.

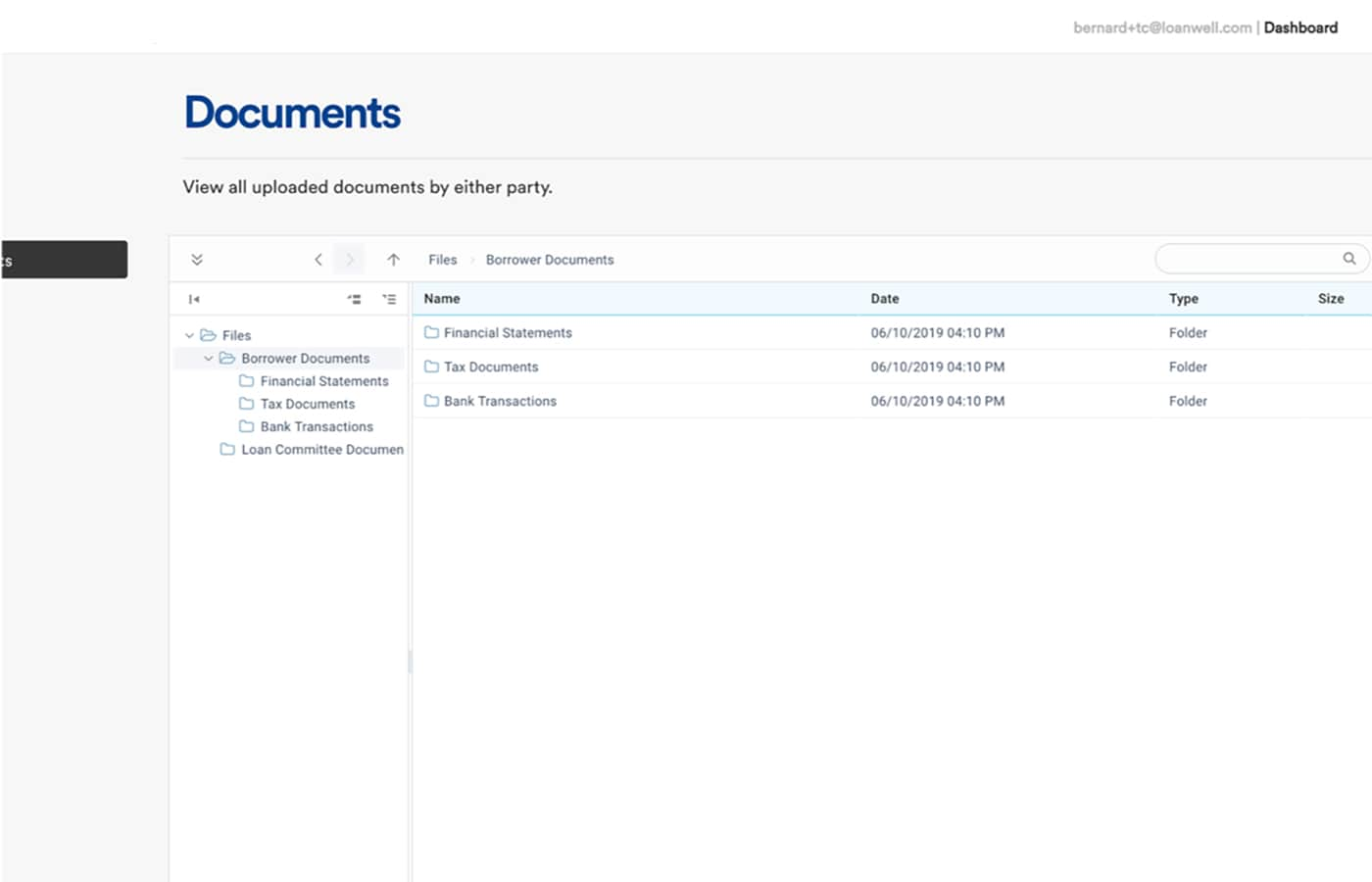

Secure Document Storage

Applicants and members of your team can upload and download documents securely with our encrypted file manager.

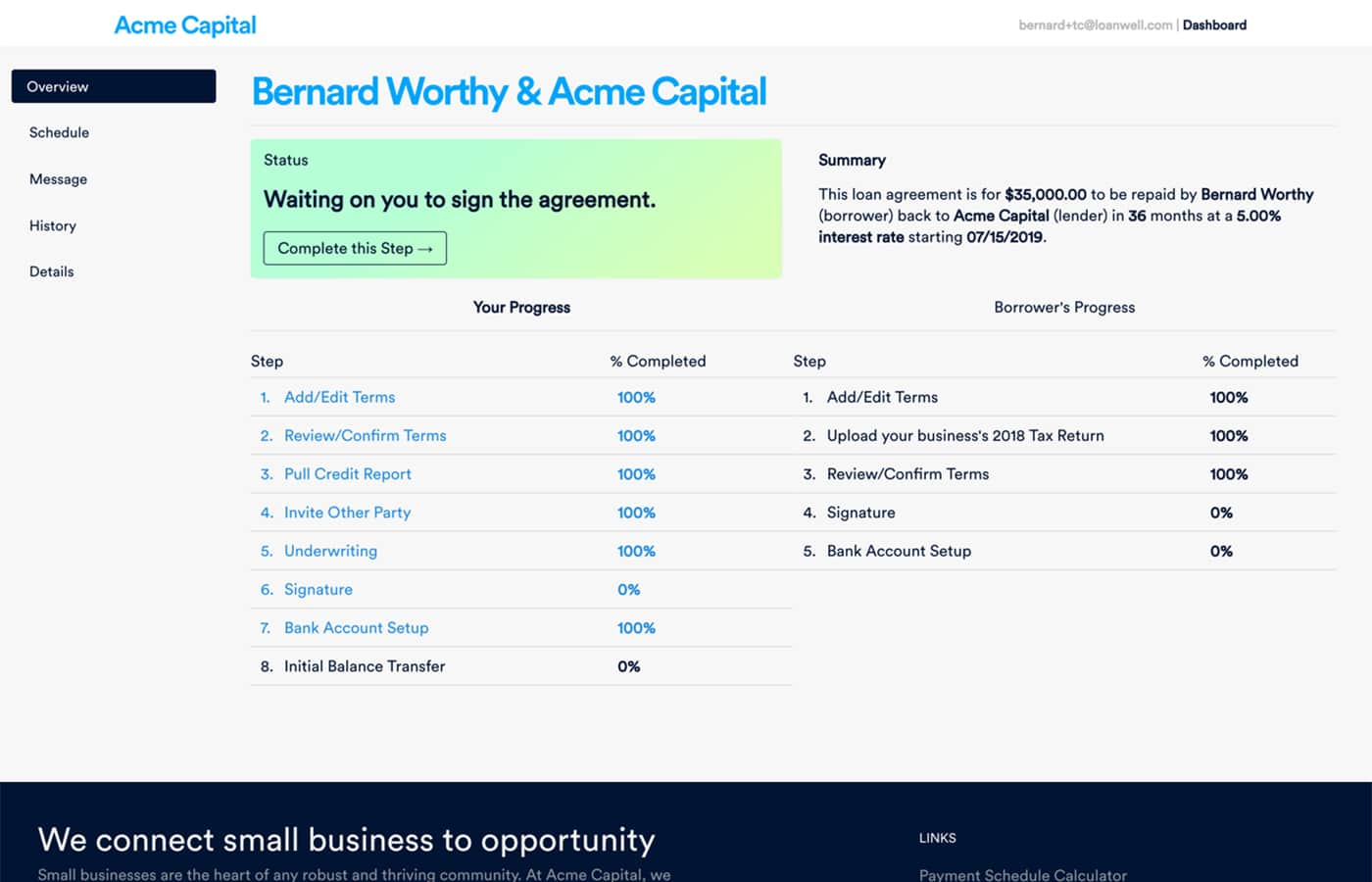

End-To-End

Workflow

Digitize your loan origination process and task your team members efficiently in our customizable workflows.

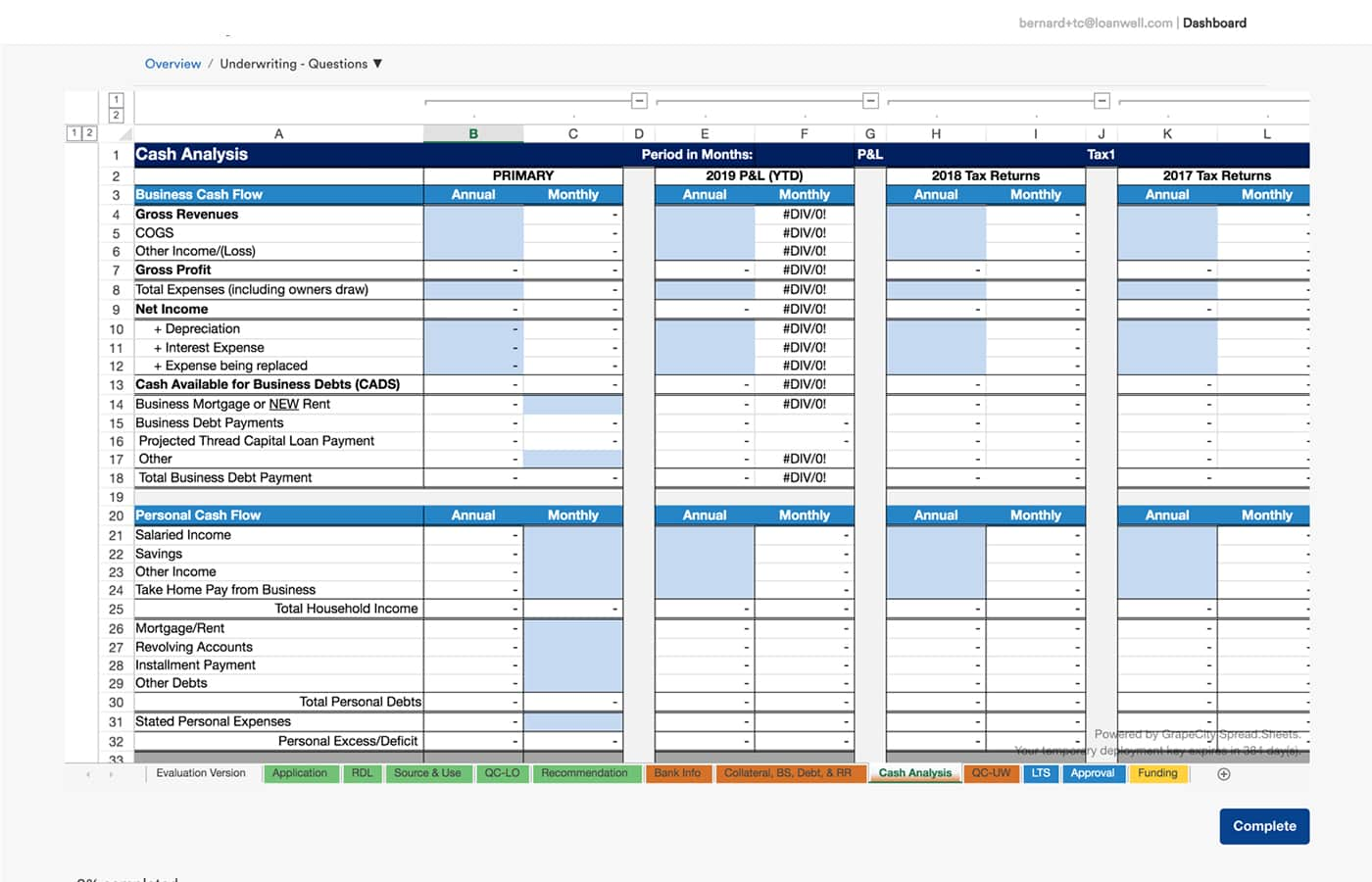

Underwriting

Made Easy

Use our auto-decisioning or bring your own Excel models to analyze the deal. The system will import self-reported data from borrowers and other team members throughout the process.

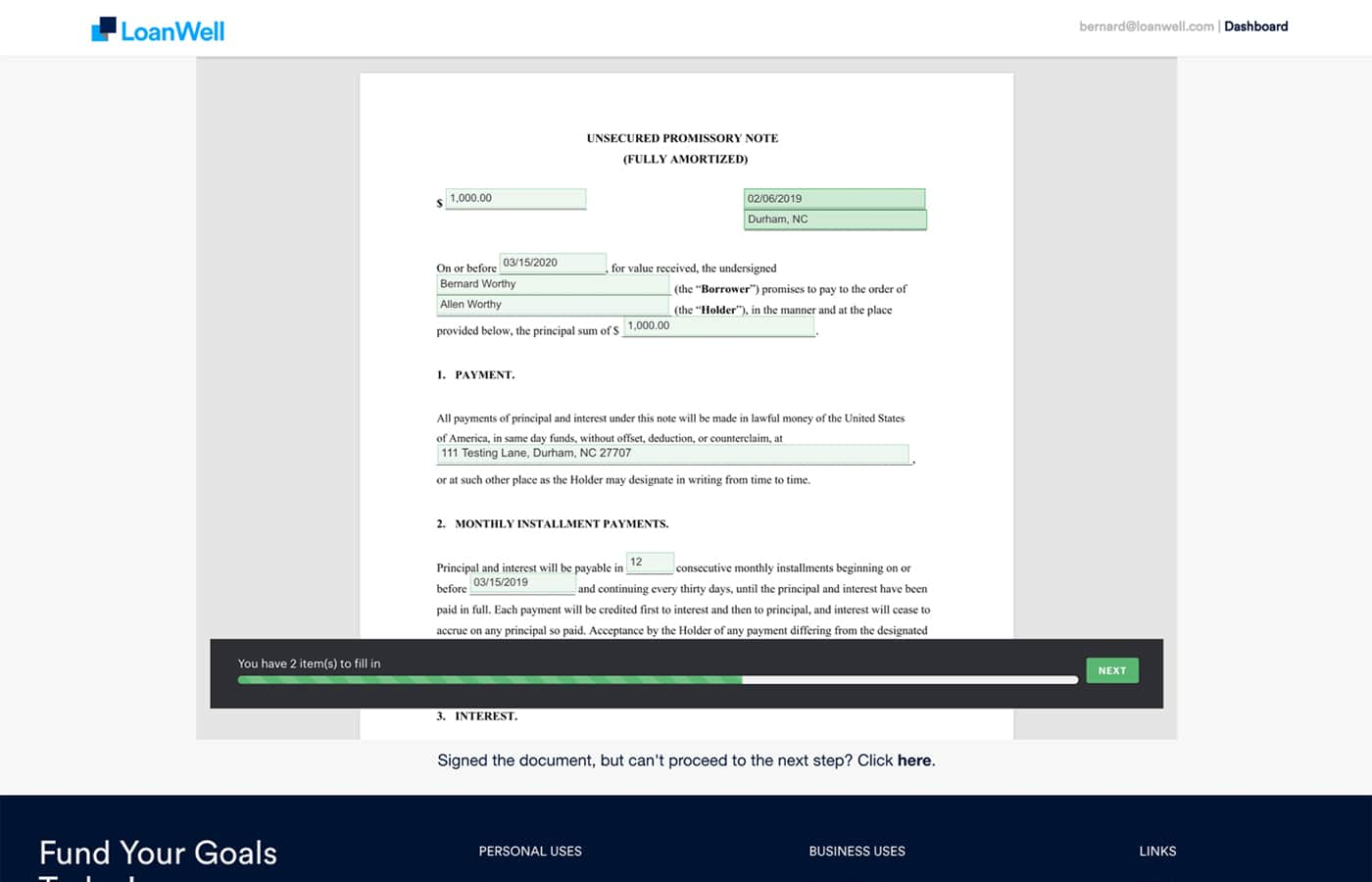

Esign Closing Packages

With LoanWell, both parties can sign the closing package and communicate directly adding convenience to the back and forth process.

Servicing Automation

We've made it as easy as possible to manage the servicing process with auto-drafted payments and automated communication to the borrower.

Create best in class products and services.

End-To-End Workflows

We help you digitize your origination process and automate the manual steps from customizable intake steps, auto-decisioning with credit pulls, esign within the platform, movement of money, and auto-drafted servicing tools.

ACH Transfers

LoanWell manages your ACH transactions for disbursement and repayment with one-time and recurring payments.

KYC & Identity Verification

LoanWell uses Lexis Nexis Instant ID to verify your applicants' identity and help manage the KYC process with our banking partner.

Documents & Reports

Store and Retrieve Documents Safely and Securely (Encrypted with AWS KMS)

Privacy and protection

LoanWell takes security very seriously and has implemented industry best practices with regards to data security, user authentication, encryption, application security, and vulnerability management leveraging the Amazon Web Services ecosystem.

Automated Messaging

With applicants, team members, vendors, and stakeholders all in the same system, LoanWell can automate specific messaging, emails, decision letters, notifications and tasks based on your permissions and role.